Data Maturity Assessment / Data Due Diligence

Data is a critical asset for a company and should be valued during the due diligence process as it influences a company’s valorization or post-deal to assess portfolio companies’ maturity and ability to generate value from their data.

Why Data Due Diligence Matters?

-

Hidden Liabilities: Poor data management, breaches, or non-compliance can lead to significant financial and reputational costs.

-

Real Investment Value: Beyond tangible assets and revenue streams, the quality and potential of a company’s data can significantly influence its market valuation.

-

Strategic Alignment: Ensuring a company’s data strategy aligns with broader business goals is vital for future integrations and scaling.

What’s the Value of Data?

-

Competitive Advantage: Data provided insights into customer patterns, preferences, and trends helping businesses anticipate market shifts, tailor offerings, and stay ahead.

-

Process Improvement: Data analytics allows to optimize operations, reduce inefficiencies. A company with strong data-driven processes indicates robust internal mechanisms.

-

Predictive Analysis: Equipped with data, companies can forecast market movements, consumer trends and operational challenges.

-

Feeding AI and Data Science Applications: The value of data is increased when used to train advanced AI and data science models, to automate tasks, enhance decision-making and identify growth potential. The effectiveness of these models is directly proportional to the quality and structure of the data.

Our Approach for Data Due Diligence / Data Maturity Assessment

The assessment of the company’s data value is done across 6 dimensions:

-

Data Inventory Catalog all data assets and sources.

-

Data Architecture Evaluate structure, storage, and access protocols for efficiency and scalability.

-

Data Quality Examine the accuracy, consistency, and completeness of data.

-

Data Utilization Understand how data drives decision-making and operational processes.

-

Security & Compliance Assess data security measures and ensure adherence to regulatory standards.

-

Use Case Identification Determine potential applications of data for operational and sales enhancements.

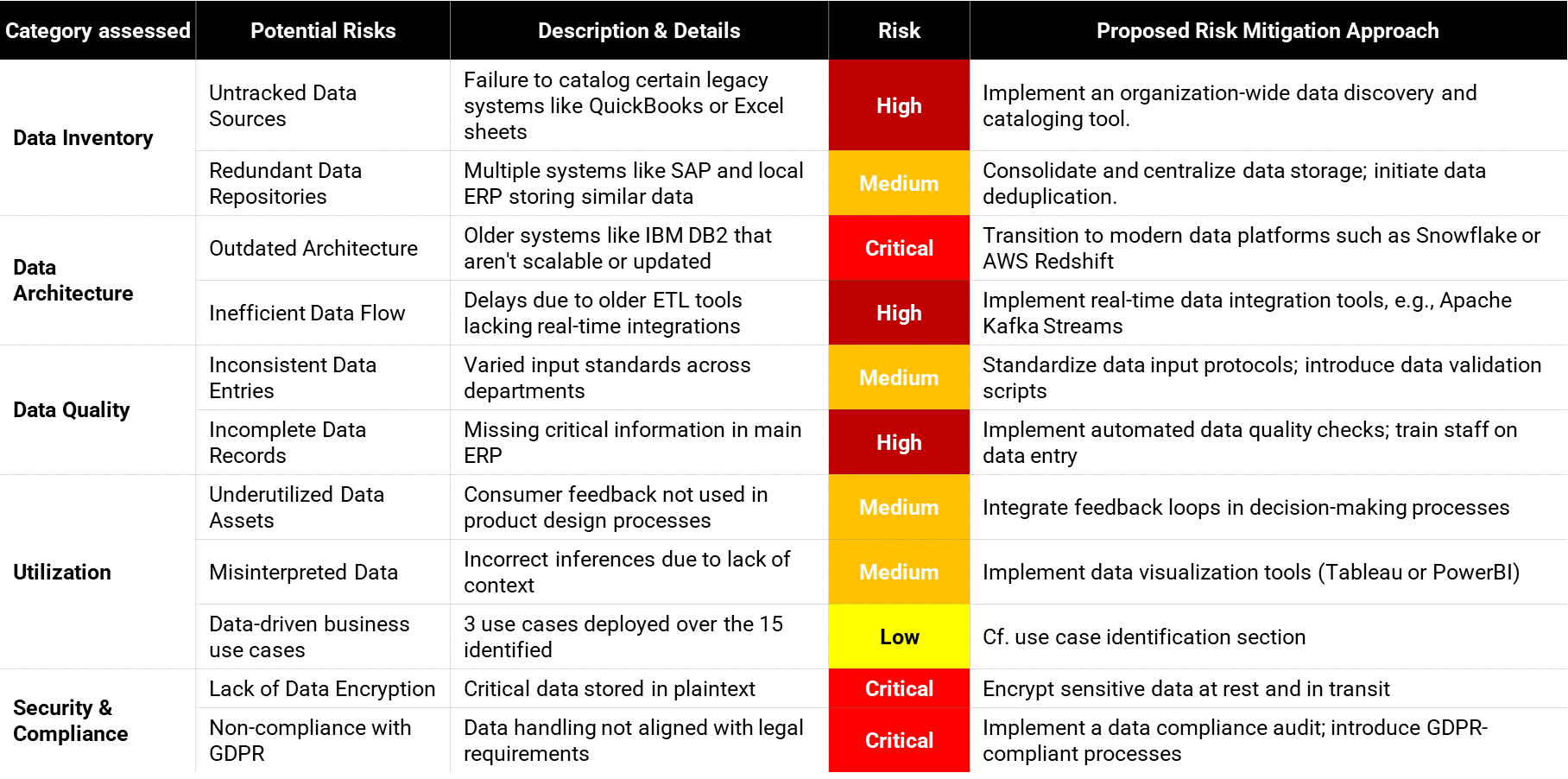

Example of deliverbale

The Data Maturity risk matrix is one of the key deliverables of this service.

The Risk Matrix reveals vulnerabilities that might affect the company’s valuation and operations.

Recognizing areas where there are outdated technologies, gaps in compliance, or operational inefficiencies can indicate a potential for additional capital outlay in the post-acquisition phase.

Extract of a risk matrix from a data due diligence of an SME operating in the packaging industry, for illustrative purposes only